As of 1 July 2018, there were new mandatory salary and super reporting requirements introduced known as Single Touch Payroll (STP).

These were mandatory for business’s who had over 20 employees at 1 April 2018, however if you were using Xero to process your payroll, you had a deferral until the end of December.

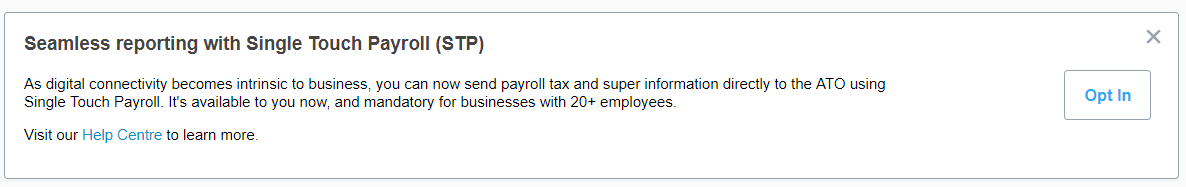

Xero have now commenced rolling out the integration for certain clients, and you may have noticed the below banner appear at the top of your Pay Run page:

If you can see this banner, there are a few steps that need to be performed so that Xero can make the connection to the ATO.

By selecting Opt In, you will be taken to a screen where you can review your organisation details and update if required – if not, you can just Continue to Step 2 where you will be asked to Connect to the ATO.

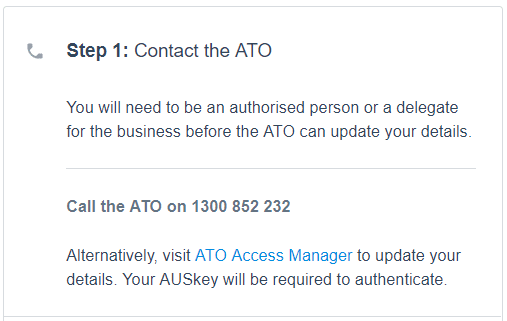

The payroll admin user who will be processing the payroll will be required to be an authorised contact with the ATO – this is something your adviser at HTA can arrange for you.

Once they have been authorised with the ATO, they will need to contact the ATO on the number provided:

You will then be able to confirm that you have contact the ATO to connect your Xero account, and register for STP.

The registration will be active immediately, and you will notice in Xero when you post a pay run that you will be able to File the pay run with the ATO.

Xero have provided instructions on how to use STP to file a pay run, and fix a filing error in an STP submission.

If you run into any issues setting up STP with Xero, please do not hesitate to contact your advisor at HTA.