Making extra repayments to your home loan – even small ones – can make a big difference!

Paying extra off your home loan – either on a regular basis or with the help of a one-off financial windfall – can save you a small fortune in interest repayments over the long term (especially when combined with finding a cheaper loan).

Make regular extra repayments

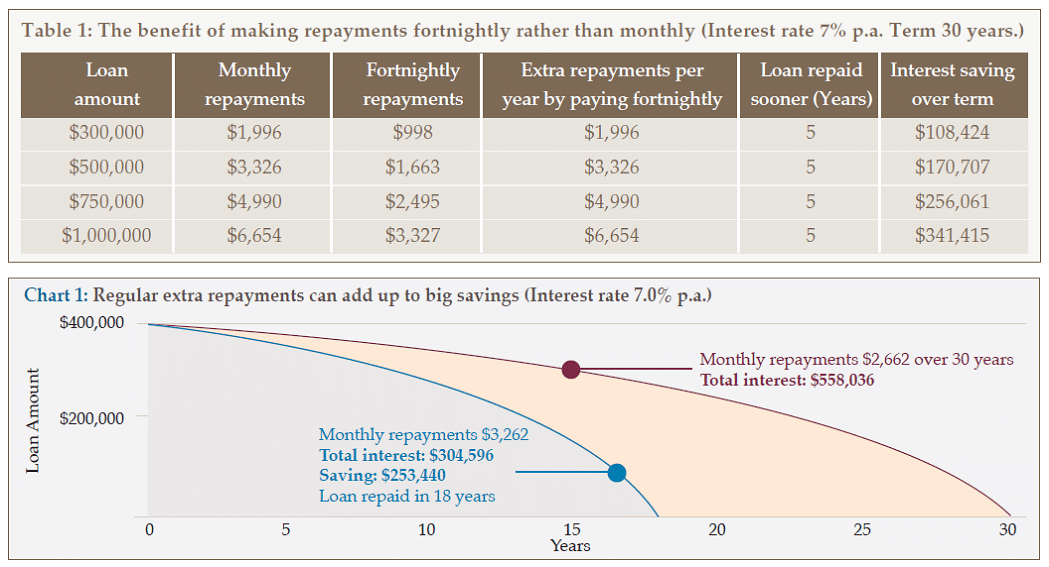

Can you pay a little extra off your home loan each month? Even reasonably small amounts can make a big difference because the extra you pay comes straight off the principle – and this will result in ongoing interest savings. For example, if you have a $400,000 loan over 30 years at 7% p.a. interest, your monthly repayments will be $2,662. If you can afford to pay an extra $600 a month, you’ll pay the loan off 12 years sooner and save $253,440 in interest, as shown in Chart 1.

Take advantage of falls in interest rates

If interest rates and therefore your required monthly repayments fall, try to maintain the old monthly repayment as a way of making extra repayments.

Pay fortnightly rather than monthly

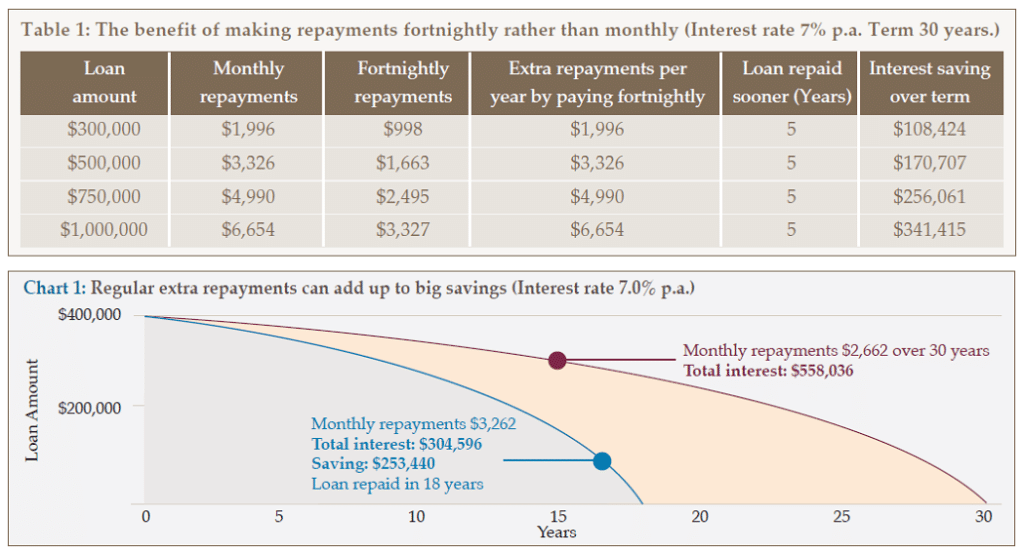

This is a useful little strategy that works because you effectively pay an extra month’s repayment each year. You simply divide your monthly repayment in two, and pay that amount every fortnight. And, because there are 26 fortnights in a year, but only 12 months, you end up paying extra off each year. For example, if your monthly repayments are $1,996, you’ll pay $23,952 a year. But you’ll pay $25,948 a year (i.e. an extra $1,996) if you use the ‘pay fortnightly’ strategy (i.e. $998 X 26). The overall interest savings can be significant, as shown in Table 1.

Use a one-off windfall to make an extra repayment

If you are a recipient of a one-off financial windfall (such as a work bonus, lottery win, redundancy payout, or inheritance), it can be a wise strategy to use some or all of that money to repay some of your home loan.

Source: Australian Unity Personal Financial Services

To discuss your home loans, interest rates and options contact our office.