Update from the 2014 Federal Budget

the Treasurer Joe Hockey delivered his first Federal budget.

The budget was in many ways what was expected, below is a summary of the key features and how they could affect you – Please get in contact with us if you would like further details on how these decisions will affect your own personal situation.

More ‘Tax’ for Higher Earners

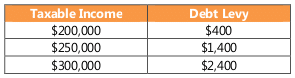

A Temporary ‘Budget repair Levy’ was introduced to tackle the rising national debt. This debt levy will affect higher income earners (over $180,000) – a rundown of the levies is as follows:

Also a number of other tax rates that are currently based on calculations that include the top marginal tax rate will also be increased in line with the Temporary Budget Repair Levy from 1 July 2014. An exception applies for fringe benefits tax (FBT), which will be increased from 47 per cent to 49 per cent from 1 April 2015 until 31 March 2017 to align with the FBT income year.

Short Term Clarity on Super

Last night’s budget confirmed the rise of the superannuation guarantee to 9.5% as of 1 July 2014 this is in-line with 2012 legislation. However the proposed schedule has changed to hold the rate 9.5% for 4 years followed by 0.5% yearly rises up to 12% by 2022/23.

Changes to the excess non-concessional contributions tax means that contributions made since 1 July 2013 can be withdrawn. This is good news for anyone who has accidentally exceeded their non-concessional contributions as they can withdraw it rather than paying the top marginal rate.

Tighter Welfare Rules

The government has proposed several clamp downs on welfare including:

-

Reduced deeming thresholds from 2017 making it harder to pass the ‘income test’ for social security benefits

-

Commonwealth Seniors Health Card changes

-

Progressively increase the Age Pension age to 70 from 2025

We want to make sure ALL our clients are ready for anything this is why we would love to talk to you about a ‘Freedom Plan’. This puts the power back into your hands by clearly identifying what you need to do to retire on your own terms. Call us today to find out how.

Family Assistance

Changes to the Family Tax Benefits (FTB) scheme include a change to Part B where the primary income limit will be reduced from $150,000 to $100,000 from 1 July 2015. Also Payment of FTB Part B will be limited to families whose youngest child is under age six from 1 July 2015. Transitional arrangements will ensure families whose youngest child is age six and over on 30 June 2015 will remain eligible for FTB Part B for two years.

The paid parental leave scheme has been proposed on a smaller scale to what was expected. It will provide six months of paid leave, including superannuation, from 1 July 2015. However, the payment threshold is proposed to be reduced from $150,000 per annum to $100,000 per annum.

Business & Investors

The company tax rate has been reduced by 1.5% bringing it down to 28.5%. This reduction, however, will be off-set by businesses that earn more than $5,000,000 in taxable income by a 1.5% levy to fund the paid parental leave scheme.

For investors, this means that little will change for those invested in businesses who earn less than $5,000,000 as the increased dividends will be offset by a decrease in franking credits. However, for those invested in companies who earn more than $5,000,000 will be worse off as they will have less franking credits as well as a decreased dividend.

That being said, with the marginal tax rate for businesses at 28.5% and the maximum individual marginal tax rate at 49% there may be some opportunities. Call us to discuss how this may impact you.

HTA Advisory are here to help you make better financial decisions now for a beautiful financial future. Talk to us to find out how we can make the best of a tight federal budget for you.