Try to visualise what the future holds for your child or grandchild…

Have you thought about putting together an Education Bond to give them a financial head start?

Home ownership dreams of yesteryear look out of reach and the job market just gets more competitive and filled with new technologies.

Your child needs advanced, flexible skills, education or a trade qualification.

Then there are your child’s other “priorities” – a first car, overseas travel or study, a wedding or starting a family.

How can your child’s or grandchild’s dreams, aspirations and potential be fulfilled?

How can you help him or her along with a financial head start?

If you find yourself thinking about the above issues please take a moment to discuss your thoughts with HTA Advisory. We can help you explore the most appropriate structure for parents and grandparents to meet the financial objectives for children and grandchildren.

Depending on your family’s financial situation and the taxation rate that applies to each individual within your family, an investment for your child in an Education Bond may look very attractive.

An Education Bond is a ‘special purpose’ long-term investment designed to build an initial capital base for your child’s or grandchild’s financial head start. The structure of this investment positioned in an Imputation Bond has many taxation advantages – your investment accumulates under a “Tax-Paid” environment with the capacity to make “Tax-Free’ distributions to you (and to your nominated child if you optionally allow it to vest).

With and Education Bond, the ownership of your bond (and its investment benefits) is automatically programmed to shift from you (e.g. parents/grandparents as original owner(s)) to your nominated child. This ownership change occurs on a particular vesting date that you set between the child’s ages of 10 and 25.

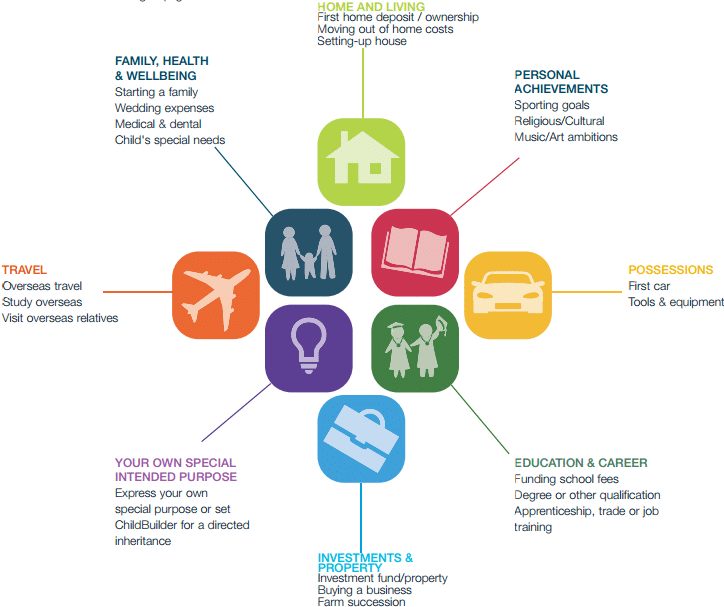

Importantly, until your bond vests, you have full ownership and full discretion to make withdrawals for your own purposes, rather than allowing its ownership to shift to your nominated child. Although your Education Bond can be used for unspecified purposes by you or your nominated child, you can optionally choose from an extensive menu of “Intended Purposes” for your Education Bond, such as a first home deposit, education and career training or overseas travel.

You can also use your Education Bond to plan ahead with “peace-of-mind” about how, when and to whom your estate’s wealth will be distributed to the next generation.

If you’d like to find out more about Education Bond or your Wealth please contact HTA Advisory and arrange a meeting with our Financial Adviser, Scott Millson.

HTA Wealth Services are provided by Scott Millson, Authorised Representative of Australian Unity Personal Financial Services Ltd AFSL 234459